Our Services

From residential appeals to commercial property tax consulting, Harding & Carbone offers expert services tailored to your needs. Explore our comprehensive solutions below.

Residential

Harding and Carbone is here to help you with all of your property tax needs. We will file your appeal, analyze your property, attend all hearings, and answer any questions you may have along the way. We have invested in our team and tools to effectively prepare for your property tax protest to help get the best results possible. We will handle your protest every year and all you have to do is sign up once. You can also access your account 24/7 through our online client portal.

When to appeal your property tax value?

Homeowners often wonder when is the right time to appeal your property tax value.

I recently purchased a home, and the appraised value is more than what I bought it for.

My neighbor has a larger and newer house than I do but their appraised value is less than mine.

In the past year my home has experienced damages due to environmental factors.

My house is not worth the appraised value set by the County.

Pricing

Clients are charged a contingency percentage fee based on savings. Our contingency rates range from 35%–40% depending on the County where your property is located. Clients with multiple residential properties may be eligible for discounted rates.

Commercial

Harding and Carbone is capable of handling a wide range of commercial property types; Apartments, Retail, Office, Warehouse, Industrial, Land Developers, and Ag/Timber properties. We specialize in protesting commercial valuation but also provide support and expertise with estimates & accruals, projections, tax prorations, split outs, tax certificates, AG rollback support, and exemption filing and management. We are also very accessible, so you will have a dedicated account manager that you can contact at any time.

Using Rent Rolls and Income Statements Harding and Carbone develops similar Income Analysis reports as Appraisal Districts, this helps illustrate discrepancies in the Appraisal Districts model. Appraisal Districts over value Warehouses due to the wide variation of uses. Whether it be an Apartment, Hotel, Warehouse, or Office we ensure that Appraisal Districts are not over valuing your property.

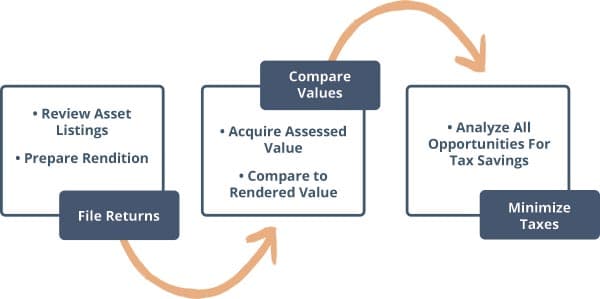

Business Personal Property

Harding and Carbone files Business Personal Property Returns in all taxable states. All States and Counties have different guidelines and methods of valuation for Personal Property. The deadline to file Personal Property Returns also varies from state to state. Our team manages these deadlines effectively to make sure that our clients do not incur penalties and interest. Let us remove the burden of tracking and verifying these deadlines.

The methods of valuation depend on the type of equipment reported. States and Counties all have their own depreciation tables for different types of equipment. Harding and Carbone will verify that your equipment is being valued in the appropriate category.

Laptop for New Office

Equipment Category:

Computer Equipment

Life Schedule:

5 Year Life

Acquisition Year:

2017

Cost:

$1,000

Depreciation Factor:

65%

Value:

$650

Types of equipment that need to be reported are not the same in every State. Typically, if you report it the County will value it. We make sure that you are only reporting what is taxable, according to State guidelines.

Services

Manage Deadlines

File Business Personal Property Returns Timely

Verify Valuation Method, and Appeal if Necessary

Tax Bill Verification

Audit Assistance

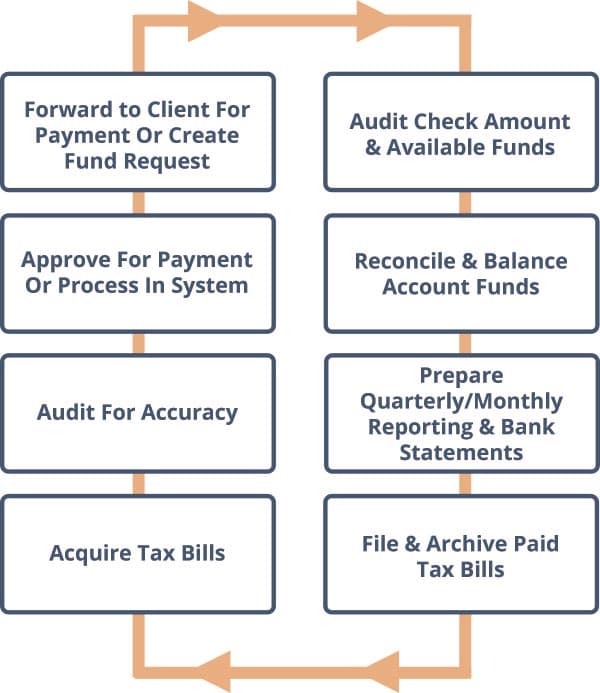

Tax Payment Processing

Harding and Carbone can offer a customizable solution to the verification and payment of property tax bills based on individual client needs. The financial strain that penalties and interest can cause is well worth having a professional manage this process for you. Our proprietary payment process has been streamlined over the past 50 years and takes the burden and pressure this process can cause off our clients. We understand how tax bills are calculated and will make sure the correct tax amount is paid.

Binding Arbitration

If you are not satisfied with the outcome of your formal appraisal review board hearing Tax Code Chapter 41A gives property owners meeting certain criteria the option of requesting binding arbitration. This filing is required to be filed not later than 60 days after receiving the order of determination from the appraisal district.

Below is a list of frequently asked questions regarding this program and what is required for property owners to qualify.

Generally, in binding arbitration, an independent, neutral arbitrator hears and examines the facts of an appeal and makes a decision that is binding on both parties. More specifically, binding arbitration, in the context of property value disputes, creates a forum in which both parties to a dispute present their positions before an impartial third party, who renders a specific award that is enforceable by law and may only be appealed as provided by Civil Practices and Remedies Code Section 171.088, for purposes of vacating an award.

A property owner may request binding arbitration if:

The property in dispute is real or personal property.

The ARB has issued a determination on the appraised or market value of the property or an unequal appraisal determination.

The disputed property’s value, as determined by the ARB, does not exceed $5 million, except for residence homesteads for which there is no value limit.

Taxes have been timely paid.

A lawsuit has not been filed in district court on the same matter.

The chart below indicates the amount of property owner deposit required and the amount of arbitrator fee allowed based on the type of property and the ARB’s determination of the property’s market or appraised value.

Arbitration Deposit and Arbitrator Fee Schedule (Effective Sept. 1, 2015)

| Property Type | Appraised or Market Value | Application Fee to Comptroller |

|---|---|---|

| Residence homestead | $500,000 or less | $450 |

| Residence homestead | More than $500,000 | $500 |

| Commercial /Not residence homestead | $1 million or less | $500 |

| Commercial/Not residence homestead | More than $1 million but not more than $2 million | $800 |

| Commercial/Not residence homestead | More than $2 million but not more than $3 million | $1,050 |

| Commercial/Not residence homestead | More than $3 million but not more than $5 million | $1,550 |

Form 50-791 Appointment of Agent for Binding Arbitration

The parties to arbitration may represent themselves or be represented by an attorney, a licensed real estate broker or salesperson, a certified real estate appraiser, a property tax consultant, or a certified public accountant. These agents must have written authorization (Comptroller Form 50-791) signed by the property owner.

Note: A lawyer does not have to have this authorization.

No. The arbitration proceedings are binding. An arbitration award may be vacated under limited situations (Civil Practices and Remedies Code Section 171.088). An appeal of the arbitrator’s award in district court cannot be filed if you are simply dissatisfied with the value determination.

The chief appraiser may only correct the appraisal roll if the arbitration award is below the order of determination.

The decision of the arbitrator is final and binding on both parties. By arbitrating the dispute, you agreed to abide by the arbitrator’s decision.

Litigation

For owners who aren’t satisfied with the appraisal review board’s value opinion, we will continue the protest by coordinating a lawsuit against the appraisal district.

Coordinate with Legal Counsel.

Provide Counsel with evidence.