Resources

Access essential tools and information to stay informed about your property tax obligations. From key Texas deadlines and exemptions to our secure client portal, Harding & Carbone provides the resources you need to manage your property taxes effectively.

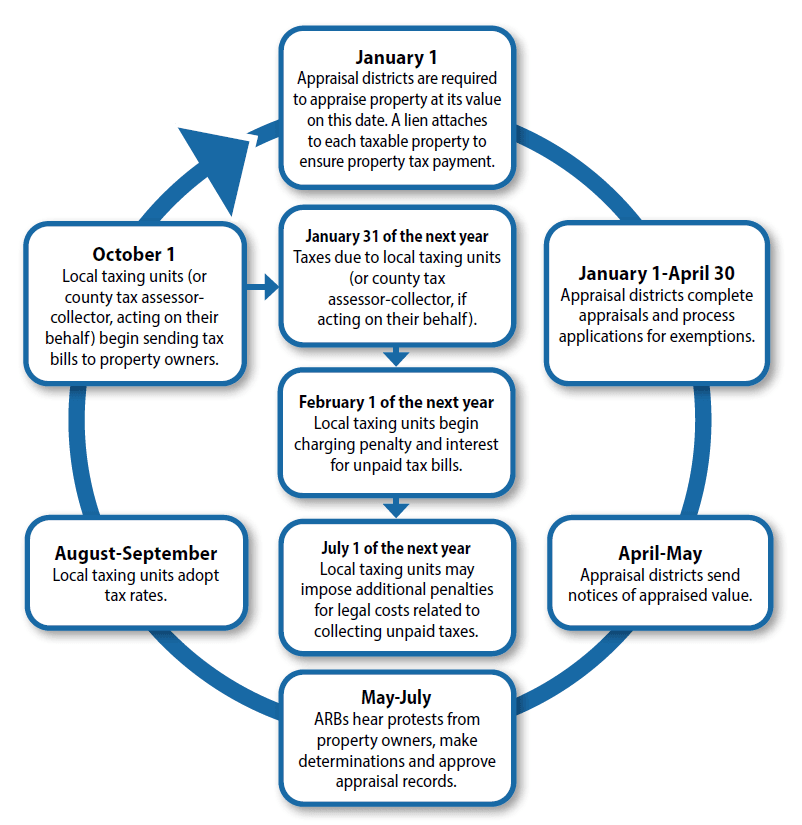

Texas Property Tax Calendar

01

Jan

Date that taxable values (except for inventories appraised Sept. 1) and qualification for certain exemptions are determined for the tax year (Secs. 11.42(a), 23.01(a), 23.12(f)).

01

Feb

Date that taxes imposed the previous year become delinquent if a bill was mailed on or before Jan. 10 of the current year (Secs. 31.02(a), 31.04(a)).

15

Apr

Last day to file renditions and property reports on most property types. Chief appraiser must extend deadline to May 15 upon written request (Sec. 22.23(a) and (b)).

01

May

Last day (or as soon as practicable thereafter) for chief appraiser to mail notices of appraised value for properties other than single-family residence homesteads (Sec. 25.19(a)).

15

May

Last day to file most protests with ARB (or by 30th day after notice of appraised value is delivered, whichever is later) (Sec. 41.44(a)(1)).

Texas Property Tax Exemptions

Association Providing Assistance to Ambulatory Health Care Centers

Cemeteries

Charitable Organizations

Community Housing Development Organizations Improving Property for Low-Income and Moderate-Income Housing

Community Land Trust

Disabled Veterans

Donated Residence Homestead of Partially Disabled Veteran

Energy Storage System in Nonattainment Area

Exemption for Cotton Stored in Warehouse

Motor Vehicle Used for Production of Income and for Personal Activities

Nonprofit Community Business Organization Providing Economic Development Services to Local Community

Nonprofit Water Supply or Wastewater Service Corporation

Offshore Drilling Equipment Not in Use

Pollution Control Property

Raw Cocoa and Green Coffee Held in Harris County

Religious Organizations

Residence Homestead

Residence Homestead of 100 Percent or Totally Disabled Veteran

Residence Homestead of Surviving Spouse of First Responder Killed in Line of Duty

Residence Homestead of Surviving Spouse of Member of Armed Forces Killed in Action

Schools

Solar and Wind-Powered Energy Devices

Temporary Exemption for Qualified Property Damaged by Disaster

Youth Spiritual, Mental and Physical Development Associations

Client Portal

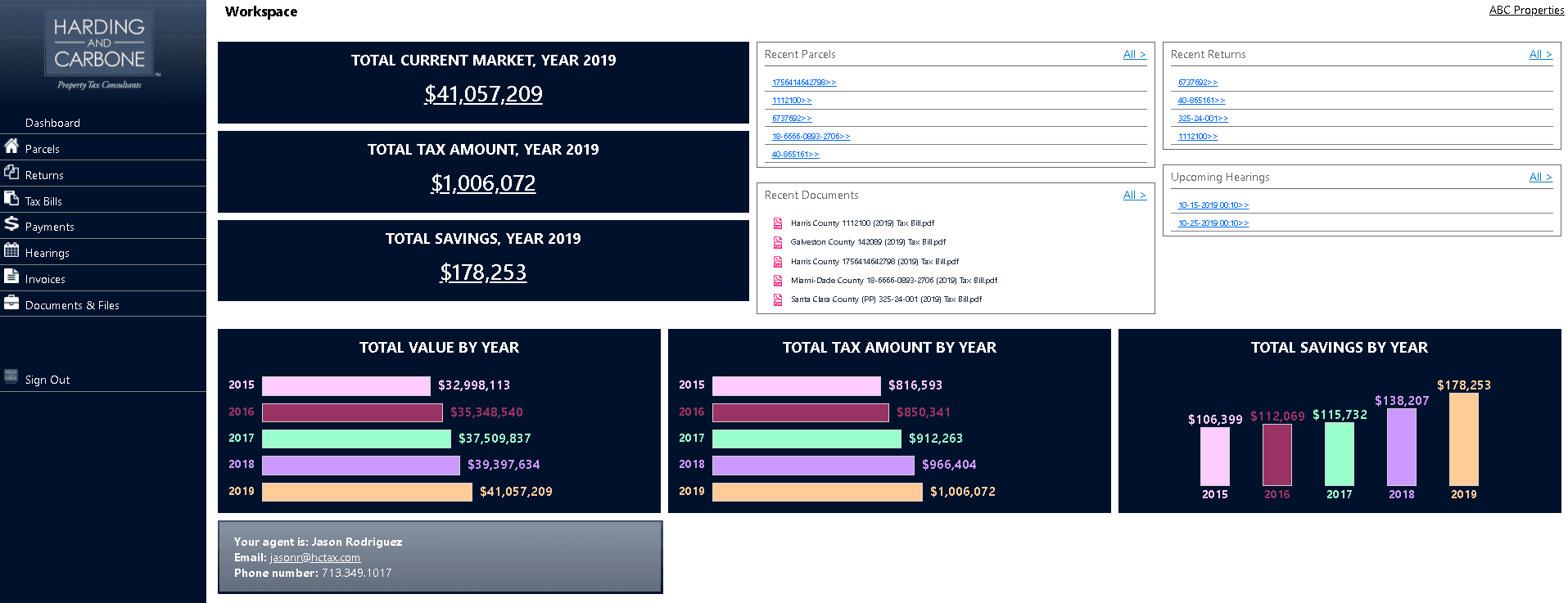

Dashboard

View your dashboard to get a quick visual summary of your property values, taxes, and savings.

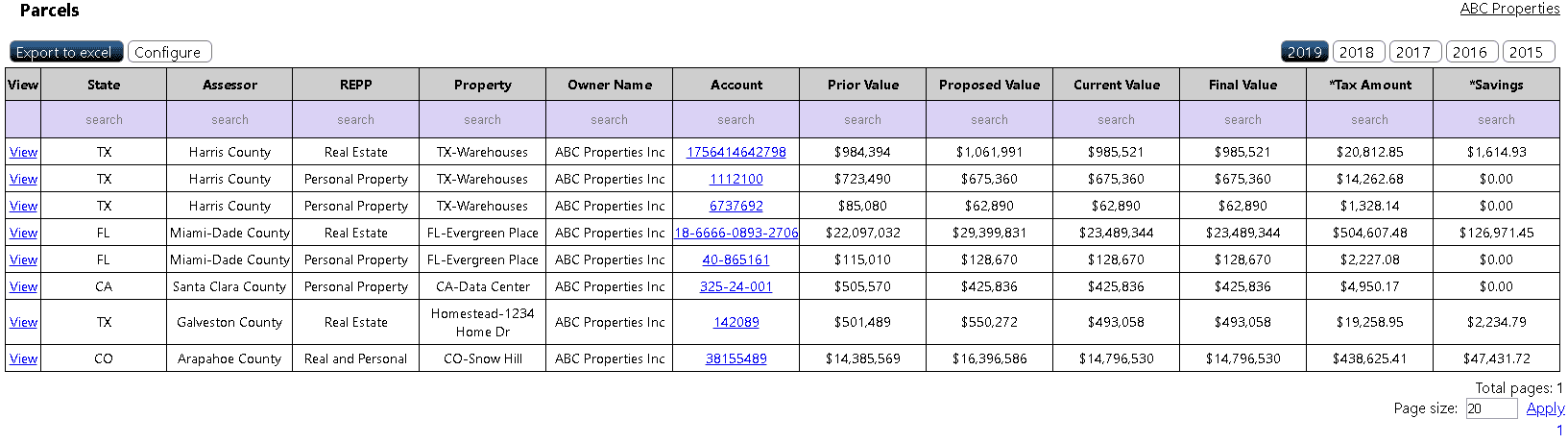

Parcels View

Review values, taxes and savings for your accounts from a grid view, with options to export your data.

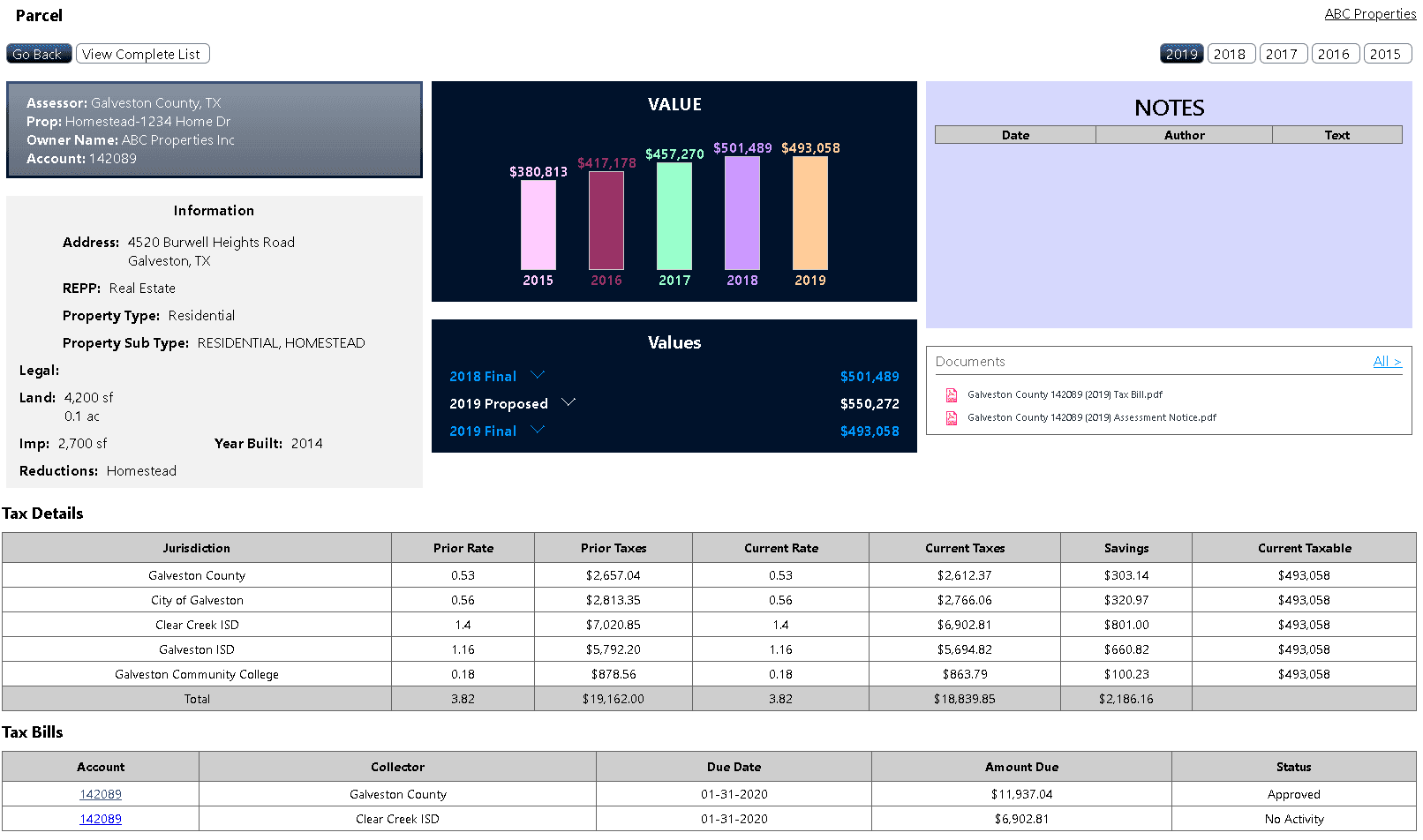

Account View

Detailed account view.